It is the ultimate gut-punch. You pull your year-end reports, and the numbers are screaming success. Your Profit and Loss statement shows a healthy, enviable net income. Your sales team is hitting targets, and on paper, you’re killing it. But when you log into your business banking app, the reality is a cold, hard slap in the face: the balance is pathetic.

You’re staring at a screen that says you’re rich, while your actual bank account says you’re broke. You find yourself pacing the floor, demanding an answer to one question: "If I’m making so much money, where the hell is the cash?"

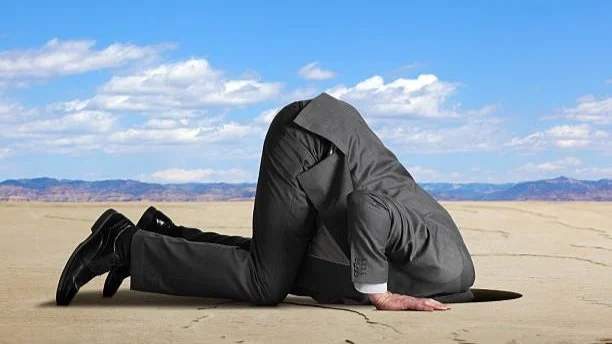

This isn’t just a "glitch" in the system; it’s the Phantom Profit Paradox, and it’s the silent killer of otherwise "successful" companies. You need to understand right now that profit is nothing more than an accounting theory. It’s an opinion.

Cash, on the other hand, is a physical fact. You can’t pay your employees with "profit." You can’t pay your rent with "net income." If you don’t bridge the gap between these two metrics immediately, your "profitable" business is going to go bankrupt with a smile on its face. It’s time to stop looking at your P&L through rose-colored glasses and start hunting down the cash thieves hiding in your operation.