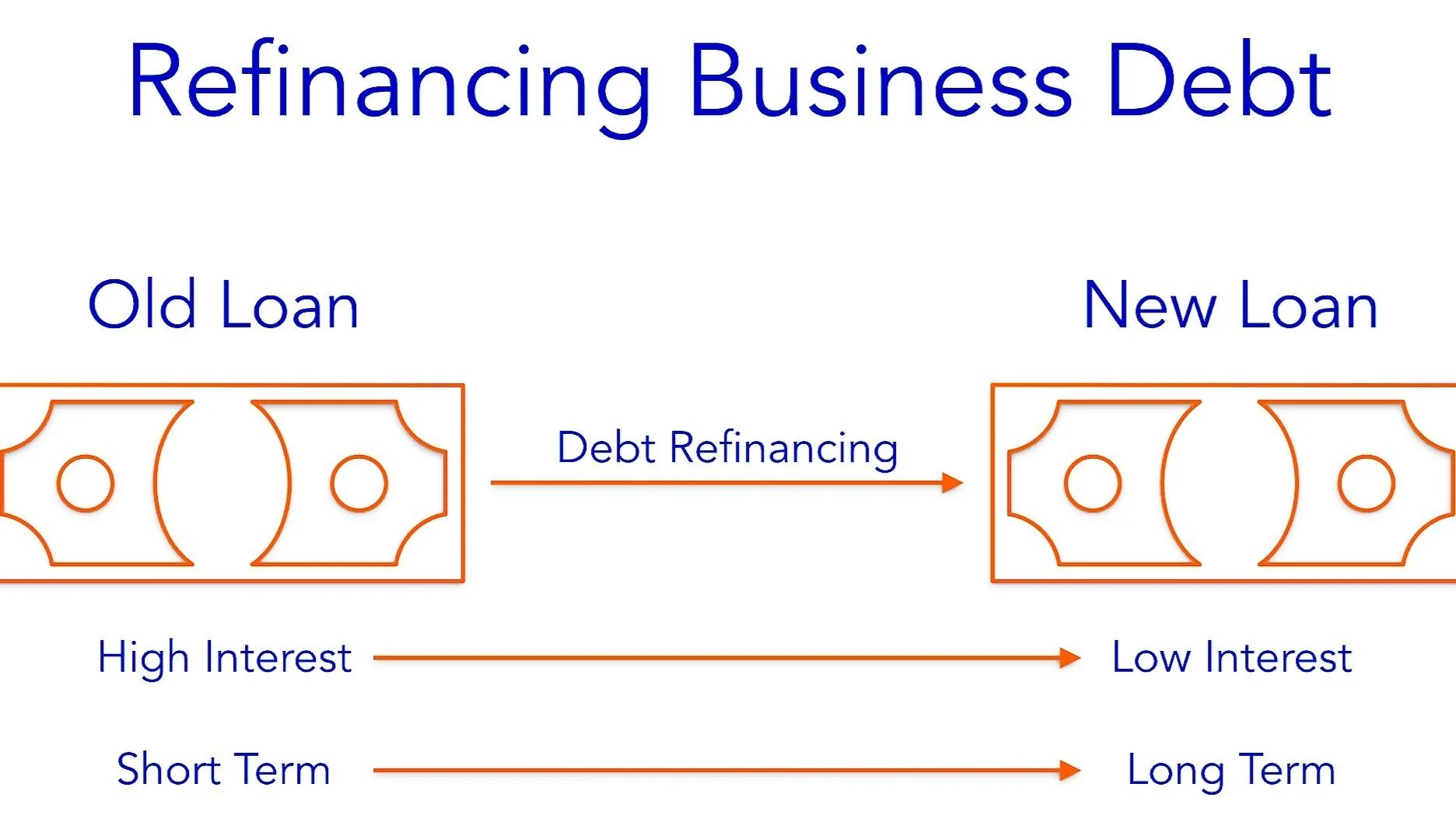

n the dynamic landscape of Business Finance, finding effective solutions to optimize Business Cash Flow savings is essential for sustained success. One extremally viable strategy is Business Debt Swapping—an approach that involves reshuffling a company's existing debt to achieve better terms and, ultimately, free up cash flow. Let’s explore the concept of Business Debt swapping, delve into its benefits and challenges, and provide insights into how Businesses can leverage this strategy to enhance their financial flexibility and increase Business Cash Flow.

Understanding Business Debt Swapping

Business Debt swapping, also known as Business Debt Refinancing or one method of Business Restructuring, is a financial maneuver where a company reorganizes its existing Business Debt obligations to secure more favorable payment terms. This can involve negotiating with current Business creditors for extending repayment periods, or consolidating multiple debts into a single, more manageable obligation and payment over a longer term than the existing term. The primary goal of Business Debt swapping is to improve a business's financial position, increase cash flow, and enhance overall operational flexibility.