General Requirements (takes about 5-minutes or less to apply online)

680+ FICO score (Transunion or Experian FICO model 8.0 or similar)

Less than 15% operating loss in the last year of business

Last 2-Years of filed Business Tax Returns; Last 1-Year of filed Personal Tax Returns

Last 3-months of bank statements; copy of Driver’s License

The Crossroads of Business Capital: A Small Business Owner’s Guide to Navigating Responsible Lending vs. Predatory Financing

For any small business owner, the need for capital is a constant and often pressing reality.

Whether it’s to fuel expansion, manage cash flow, or simply keep the lights on during a slow season, external financing can be the lifeblood of an enterprise.

However, the landscape of business funding is a dual-natured environment.

On one side lies the world of responsible lending, characterized by thorough underwriting and a genuine interest in the borrower's success.

On the other, a darker, more treacherous path awaits, paved by predatory cash flow lenders who prioritize their own exorbitant profits over the well-being of the businesses they claim to help.

Understanding the fundamental differences between these two worlds is not just a matter of good business sense; it is a crucial element of survival and sustainable growth.

This article will serve as your guide, illuminating the stark contrasts between responsible underwriting and the predatory practices of certain cash flow lenders.

We will delve into their distinct approaches to evaluating your business, the true costs associated with each, and the critical red flags that can help you steer clear of financial ruin.

The Bedrock of Prudent Finance: Understanding Responsible Lending and Underwriting

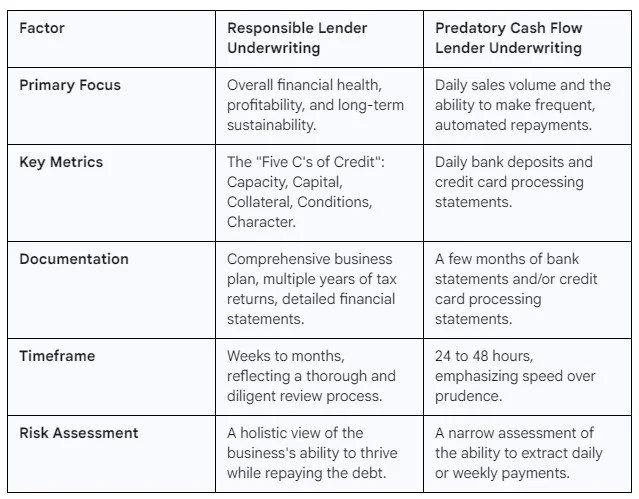

Responsible lenders, a category that includes traditional banks, credit unions, and reputable online lenders, operate on a principle of shared success.

Their goal is to provide capital to businesses that have a strong likelihood of repaying the loan while continuing to thrive.

This philosophy is embedded in their underwriting process, a comprehensive evaluation of your business’s financial health and future prospects.

This process is often summarized by the "Five C's of Credit," a time-tested framework for assessing risk:

Capacity: This is arguably the most critical component. The lender will meticulously analyze your business's cash flow to determine its ability to comfortably meet its debt obligations. They will scrutinize your historical and projected financial statements, including profit and loss statements, balance sheets, and cash flow statements. A healthy and consistent cash flow demonstrates your capacity to take on new debt without jeopardizing your day-to-day operations.

Capital: Lenders want to see that you have some "skin in the game." The amount of your own money that you have invested in the business, known as owner's equity, is a strong indicator of your commitment and confidence in your venture. A significant personal investment signals to lenders that you are less likely to walk away at the first sign of trouble.

Collateral: While not always a requirement, especially for smaller loans, collateral provides the lender with a secondary source of repayment. This can include business assets such as real estate, equipment, or inventory. Pledging collateral reduces the lender's risk and can often lead to more favorable loan terms.

Conditions: The lender will consider the external factors that could impact your business's success. This includes the overall economic climate, the health of your specific industry, and the competitive landscape. They will also want to understand the purpose of the loan and how it will be used to strengthen your business. A well-articulated and strategic use of funds is a positive signal.

Character: This is a more subjective but equally important element. The lender will assess your personal and business credit history, your experience in your industry, and your overall reputation. A strong track record of financial responsibility and a solid business plan contribute to a positive assessment of your character.

The underwriting process for a responsible loan is undeniably thorough and can take time. You will be expected to provide a comprehensive business plan, several years of tax returns (both business and personal), and detailed financial statements.

While this may seem arduous, it is a sign of a lender who is doing their due diligence to ensure that the loan is a sound investment for both parties.

The Siren Song of "Easy Money": Unmasking Predatory Cash Flow Lenders

In stark contrast to the methodical approach of responsible lenders, predatory cash flow lenders often lure business owners with the promise of fast, easy cash with minimal documentation.

Their primary product is often a Merchant Cash Advance (MCA) or a similar high-cost, short-term financing agreement. While they may present these as a "purchase of future receivables" rather than a loan, the functional reality for the business owner is a high-cost form of debt.

The underwriting process for these products is deceptively simple and dangerously narrow.

Instead of a holistic review of your business's health, these lenders typically focus on one key metric: your daily credit and debit card sales volume.

If you have a high volume of daily transactions, you are likely to be approved, often within 24 to 48 hours.

This laser focus on daily cash flow is the cornerstone of their predatory model.

They are not primarily concerned with your profitability, your long-term viability, or your ability to sustain your business after taking on their high-cost capital.

Their underwriting is designed to ensure one thing: that you have enough daily income for them to extract their repayment, which is typically done through a fixed daily or weekly withdrawal from your bank account.

The True Cost of Capital: Unpacking Fees and Repayment Structures

The differences in underwriting philosophies are directly reflected in the cost and structure of the financing.

Responsible Lenders:

Annual Percentage Rate (APR): Responsible lenders are required by the Truth in Lending Act (TILA) to disclose the APR, which represents the true annual cost of borrowing, including interest and most fees. This allows for a clear and direct comparison between different loan products.

Monthly Payments: Repayment is typically structured in predictable monthly installments over a set period, making it easier to budget and manage cash flow.

Transparent Fees: While there are fees associated with traditional loans (origination fees, closing costs), they are generally disclosed upfront and are a relatively small percentage of the total loan amount.

Predatory Cash Flow Lenders:

Factor Rates: Instead of an APR, predatory lenders often use a "factor rate," a seemingly simple multiplier that obscures the true cost of the financing. A factor rate of 1.4 on a $50,000 advance means you will repay $70,000. While this may sound straightforward, when you consider the short repayment term (often 6-12 months), the effective APR can easily soar into the triple digits.

Daily or Weekly Repayments: The hallmark of these products is the aggressive repayment schedule. A fixed amount is withdrawn from your bank account every business day or week, regardless of your sales on that particular day. This relentless drain on your cash flow can be crippling, especially for businesses with seasonal or fluctuating revenue.

Hidden Fees: On top of the high factor rate, you may be subject to a variety of hidden fees, including application fees, underwriting fees, and wire transfer fees, which are often deducted from the initial advance amount, meaning you receive less cash than you were approved for.

The Debt Spiral: The Dangers of Daily Repayments

The daily repayment structure of many cash flow products is a particularly insidious feature. It can create a vicious cycle of debt that is difficult to escape. Here’s how it unfolds:

The Initial Squeeze: The constant daily withdrawals put immense pressure on your working capital, making it difficult to pay for inventory, payroll, and other essential expenses.

The Need for More Capital: To cover the shortfall created by the aggressive repayments, you may be tempted to take on another cash advance, a practice known as "stacking."

The Compounding Crisis: You now have multiple daily payments being withdrawn from your account, further depleting your cash flow and pushing your business closer to the brink.

The Inevitable Default: Eventually, the combined weight of these high-cost advances becomes unsustainable, leading to default, potential legal action, and the possible demise of your business.

Red Flags: How to Spot a Predatory Lender

Navigating the financing landscape requires a vigilant eye. Here are some critical red flags that should immediately raise your suspicions:

Guaranteed Approval or No Credit Check: Responsible lenders will always assess your creditworthiness. A promise of guaranteed approval is a major warning sign.

Pressure to Act Quickly: Predatory lenders often create a false sense of urgency, pressuring you to sign an agreement before you have had time to fully understand the terms.

Lack of Transparency on Costs: If a lender is evasive about the APR or cannot provide a clear breakdown of all fees, walk away.

Focus on Daily Sales, Not Overall Health: If the lender's primary interest is your daily bank deposits and they show little concern for your profitability or business plan, they are likely not a responsible partner.

Aggressive and Unsolicited Offers: Be wary of lenders who bombard you with unsolicited emails, phone calls, and text messages.

No Physical Address or Vague Contact Information: A legitimate lender will have a clear and verifiable physical presence.

General Requirements (takes about 5-minutes or less to apply online)

680+ FICO score (Transunion or Experian FICO model 8.0 or similar)

Less than 15% operating loss in the last year of business

Last 2-Years of filed Business Tax Returns; Last 1-Year of filed Personal Tax Returns

Last 3-months of bank statements; copy of Driver’s License

The Power of Prudence:

Making the Right Choice for Your Business

Choosing the right financing partner is one of the most consequential decisions you will make as a small business owner. The allure of "fast and easy" cash from a predatory lender can be tempting, especially when you are facing a financial crunch. However, the long-term consequences of these high-cost products can be catastrophic.

By taking the time to understand the principles of responsible lending and the deceptive tactics of predatory players, you empower yourself to make informed decisions that will support the long-term health and success of your business.

Building a strong financial foundation through careful planning, meticulous record-keeping, and a commitment to responsible borrowing will not only help you secure the capital you need but also ensure that your entrepreneurial journey is one of sustainable growth and prosperity.

Remember, the cheapest money is not always the best money. In the world of business financing, a thorough and prudent approach will always be your most valuable asset.

WHAT IS THE BEST AND SAFEST WAY FOR YOUR BUSINESS TO DEAL WITH HIGH BUSINESS DEBT PAYMENTS?

It is NOT by stopping ACH payments.

It is NOT by taking on another business loan.

It is NOT ALWAYS a Refinancing

It is NOT by entering into a debt settlement program.

Find out the BEST strategies to get your Business back to where it was